Below is letter from US Congressman Alan Grayson. It’s a breakdown of the money the Federal Reserve gave out to save rich investors from their own incompetence. Everybody assumes the Federal Reserve was out to save the banks. That’s not true. The Fed was out to save wealthy investors. If they hadn’t, a lot of rich people would be applying for jobs at Seven-Eleven. A ton of political campaign money would have dried up. A lot of money that corrupts the political system would be gone. A ton of corruption would have died. Goldman Sachs would’ve disappeared into bankruptcy. So while saving rich investors from their own stupidity, the Fed was also ensuring the continued corruption of the corporate wing of the supreme court, congress and the presidency.

There is one other matter I disagree with Congressman Grayson about in regard to the Fed’s actions. The Fed says most of the money it lent out has been paid back. That may not be true. If fact, it’s probably not true. The Fed may, or most likely, have simply cooked its own books to make it appear so. Maybe that’s why corporate profits are at record highs during this period of suppressed demand. How could they have record profits? How could they have paid back $26 trillion in loans in such a short time? That’s almost twice the domestic product of the entire United States. There’s only one answer. It’s not possible. They didn’t pay the money back, at least not most of it. The loans that were not paid back are being used to increase corporate earnings. The higher profits are going toward higher dividends and enhanced share prices for the wealthy. That makes the loans another conduit of unearned income for wealthy investors, as well as another pipeline for government corruption. Corruption is rampant, so don’t think the Fed is immune from it, since it saved the corrupters of Democracy, and likely made them richer in the process.

There’s something significantly more to this scandal and it goes something like this. But first, we need a definition.

A credit default swap is an insurance policy, usually provided on bonds backed by home mortgages. According to some sources, there were $60+ trillion worth of these insurance policies at the beginning of the housing collapse in the summer of 2006.

You didn’t need to own any of these bonds to insure them. It’s the same as being able to insure your neighbor’s house, without their knowledge, even if you don’t know the owner. Needless to say, you’d have a fair degree of incentive to burn your neighbor’s house down.

Institutions such as Goldman Sachs and a ton of unregulated investment firms called hedge funds took out insurance policies on mortgage backed bonds. These people were betting the market would collapse. They were right, even though some of them were selling the bonds up to the housing collapse and even a little after it began, even while telling hapless and really stupid (but wealthy) investors what wonderful investments the bonds were.

This leads me to believe that trillions of those dollars of unrepaid Federal Reserve loans went toward reimbursing the holders of the credit default swaps, which may be why all of those Goldman Sachs and Citicorp executives and hedge fund managers have been getting wonderful bonuses during the economic collapse they helped to craft.

Think about it. The government bailed out the insurance company AIG because of the billions of dollars of mortgage backed bonds it had insured, and that subsequently become worthless when the housing market melted down.

Let’s be clear about one thing. The government didn’t bail out AIG, although they technically did. The government actually bailed out the rich investors by bailing out AIG. These were the foolish folks that had bet that the mortgage-backed-bond market would collapse, and they’d get rich when their insurance policies (credit default swaps) bore fruit. And then came the fat surprise!

The entire insurance industry of planet Earth couldn’t possibly pay out $60+ trillion to those who’d bet on the housing market collapse. That means a bunch of rich fat cats made a bet on a market (credit default swaps) that could not sustain itself. They lost their shirts because they were dumber than a cat’s fart. Unless, of course, they expected the Fed to save their worthless hides.

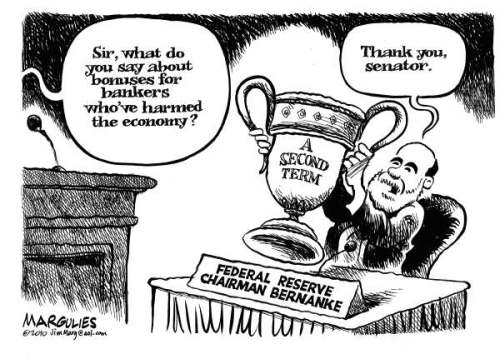

The Fed’s rescue was most likely negotiated by Fed officials and Wall Street executives in one or more secret meetings. It’s possible executives simply begged Bernanke for financial salvation and he relented, but that’s unlikely.

Either way, the Fed stepped in to save their extraordinarily wealthy friends, like Goldman Sachs, their investors and numerous hedge funds.

In other words, if you were rich and dumb and placed your money in a market that was doomed to collapse, like the credit default swap market, you should have lost all of the premiums that you paid out. Coincidentally, although sizable (probably exceeding a trillion dollars), the money paid out in premiums represented only a fraction of the $60 trillion sized market.

The Federal Reserve doesn’t serve the common people or the nation. The officials at the Fed have only one thing in mind; to serve the wealthy people that control them.

So let me restate this succinctly: The Fed has paid out trillions of dollars in alleged loans and claimed they were paid back when it was impossible to have done so. The recipients of the money, the richest of people and investment companies that control the world’s most powerful government, also had to have cooked their books in order to make it appear they paid the money back.

That means they couldn’t have paid any taxes on trillions of dollars of free income provided by the Federal Reserve Bank.

Ben Bernanke is part of this crime wave. We’re also talking about hedge fund managers, investors of all stripes and sizes, basically, a ton of rich people. Obama may have even known of this crime. Why else would the Department of Justice be totally blind to this issue? Where is the investigation? Even if we had one, the crimes would be white washed in an ocean of corruption.

But then there’s the fear factor. If common people even knew there was an investigation, the demands for justice would be massive since most people now know or suspect how corrupt the financial sector and the government are, and how much and how tightly they are entwined.

I’m no attorney, but I can kind of guess what crimes have been committed, at least some of them. How about tax evasion? How about Accessory to Tax Evasion? How about obstruction of justice? Racketeering? Money laundering? And probably lots more. If you’re rich, you own enough politicians and Supreme Court and other justices that no charges will ever be brought against you.

The folks at http://criminal.laws.com/rico define racketeering this way, “Racketeering is classified as a crime that takes place through or while undertaking an illegal business or commercial venture. The activity of Racketeering is neither specific to solely illegal nor legal business operations. A wide array of the types of Racketeering exists.”

Goldman Sachs and other banks are businesses. So are hedge funds. So racketeering applies.

Criminal.laws.com also defines money laundering as “a financially-based criminal act that is employed in order to purposely conceal, misrepresent, and disguise all applicable nature or details with regard to financial income in the form of monies. Money Laundering can be instituted in order to attempt to hide the source of generation of a particular flow of income or to mask the process of the spending of monies. Furthermore, Money Laundering can be utilized in order to mislead investigations involved in the determination of the particular spending pattern or trend with regard to an individual or entity. While Money Laundering is not specific to commercial activity, it most commonly takes place within the scope of business activity.”

Money laundering clearly applies and it should be obvious to anybody with a second grade education.

Ben Bernanke is up to his neck in these crimes. Perhaps more realistically, he buried himself completely in it.

Crimes have been committed on a massive scale, but our government is totally corrupted by big money, and that’s especially true of the corporate wing of the Supreme Court. So don’t expect anything to happen soon. Join the Occupy Movement. Get Busy. Get Politically active if you want to see justice served, if you want to see our government washed clean of corruption.

Anyway, the link below takes a look at what President Obama may or may not have known about the $26 trillion and how his knowledge impacted one of the policies he proposed. The link below that is important information about the Federal Reserve. Enhancing corporate profits was not the only thing done with the unrepaid money; the third link below goes into that issue. Much of the money went to pay off rich people holding credit default swaps.

Congressman Grayson’s letter is below the third link.

The enormous implications of the bailout to the 99 percent. Click here for an analysis of what Obama may have known about the $26 trillion

Who Holds the Federal Reserve Responsible for Its Actions?

Why Isn’t Federal Reserve Chairman Ben Bernanke in Prison for Life?

Dear John,

I think it’s fair to say that Congressman Ron Paul and I are the parents of the GAO’s audit of the Federal Reserve. And I say that knowing full well that Dr. Paul has somewhat complicated views regarding gay marriage.

Anyway, one of our love children is a massive 251-page GAO report technocratically entitled “Opportunities Exist to Strengthen Policies and Processes for Managing Emergency Assistance.” It is almost as weighty as that 13-lb. baby born in Germany last week, named Jihad. It also is the first independent audit of the Federal Reserve in the Fed’s 99-year history.

Feel free to take a look at it yourself, it’s right here. It documents Wall Street bailouts by the Fed that dwarf the $700 billion TARP, and everything else you’ve heard about.

I wouldn’t want anyone to think that I’m dramatizing or amplifying what this GAO report says, so I’m just going to list some of my favorite parts, by page number.

Page 131 – The total lending for the Fed’s “broad-based emergency programs” was $16,115,000,000,000. That’s right, more than $16 trillion. The four largest recipients, Citigroup, Morgan Stanley, Merrill Lynch and Bank of America, received more than a trillion dollars each. The 5th largest recipient was Barclays PLC. The 8th was the Royal Bank of Scotland Group, PLC. The 9th was Deutsche Bank AG. The 10th was UBS AG. These four institutions each got between a quarter of a trillion and a trillion dollars. None of them is an American bank.

Pages 133 & 137 – Some of these “broad-based emergency program” loans were long-term, and some were short-term. But the “term-adjusted borrowing” was equivalent to a total of $1,139,000,000,000 more than one year. That’s more than $1 trillion out the door. Lending for these programs in fact peaked at more than $1 trillion.

Pages 135 & 196 – Sixty percent of the $738 billion “Commercial Paper Funding Facility” went to the subsidiaries of foreign banks. 36% of the $71 billion Term Asset-Backed Securities Loan Facility also went to subsidiaries of foreign banks.

Page 205 – Separate and apart from these “broad-based emergency program” loans were another $10,057,000,000,000 in “currency swaps.” In the “currency swaps,” the Fed handed dollars to foreign central banks, no strings attached, to fund bailouts in other countries. The Fed’s only “collateral” was a corresponding amount of foreign currency, which never left the Fed’s books (even to be deposited to earn interest), plus a promise to repay. But the Fed agreed to give back the foreign currency at the original exchange rate, even if the foreign currency appreciated in value during the period of the swap. These currency swaps and the “broad-based emergency program” loans, together, totaled more than $26 trillion. That’s almost $100,000 for every man, woman, and child in America. That’s an amount equal to more than seven years of federal spending — on the military, Social Security, Medicare, Medicaid, interest on the debt, and everything else. And around twice American’s total GNP.

Page 201 – Here again, these “swaps” were of varying length, but on Dec. 4, 2008, there were $588,000,000,000 outstanding. That’s almost $2,000 for every American. All sent to foreign countries. That’s more than twenty times as much as our foreign aid budget.

Page 129 – In October 2008, the Fed gave $60,000,000,000 to the Swiss National Bank with the specific understanding that the money would be used to bail out UBS, a Swiss bank. Not an American bank. A Swiss bank.

Pages 3 & 4 – In addition to the “broad-based programs,” and in addition to the “currency swaps,” there have been hundreds of billions of dollars in Fed loans called “assistance to individual institutions.” This has included Bear Stearns, AIG, Citigroup, Bank of America, and “some primary dealers.” The Fed decided unilaterally who received this “assistance,” and who didn’t.

Pages 101 & 173 – You may have heard somewhere that these were riskless transactions, where the Fed always had enough collateral to avoid losses. Not true. The “Maiden Lane I” bailout fund was in the hole for almost two years.

Page 4 – You also may have heard somewhere that all this money was paid back. Not true. The GAO lists five Fed bailout programs that still have amounts outstanding, including $909,000,000,000 (just under a trillion dollars) for the Fed’s Agency Mortgage-Backed Securities Purchase Program alone. That’s almost $3,000 for every American.

Page 126 – In contemporaneous documents, the Fed apparently did not even take a stab at explaining why it helped some banks (like Goldman Sachs and Morgan Stanley) and not others. After the fact, the Fed referred vaguely to “strains in the financial markets,” “transitional credit,” and the Fed’s all-time favorite rationale for everything it does, “increasing liquidity.”

81 different places in the GAO report – The Fed applied nothing even resembling a consistent policy toward valuing the assets that it acquired. Sometimes it asked its counterparty to take a “haircut” (discount), sometimes it didn’t. Having read the whole report, I see no rhyme or reason to those decisions, with billions upon billions of dollars at stake.

Page 2 – As massive as these enumerated Fed bailouts were, there were yet more. The GAO did not even endeavor to analyze the Fed’s discount window lending, or its single-tranche term repurchase agreements.

Pages 13 & 14 – And the Fed wasn’t the only one bailing out Wall Street, of course. On top of what the Fed did, there was the $700,000,000,000 TARP program authorized by Congress (which I voted against). The Federal Deposit Insurance Corp. (FDIC) also provided a federal guarantee for $600,000,000,000 in bonds issued by Wall Street.

There is one thing that I’d like to add to this, which isn’t in the GAO’s report. All this is something new, very new. For the first 96 years of the Fed’s existence, the Fed’s primary market activities were to buy or sell U.S. Treasury bonds (to change the money supply), and to lend at the “discount window.” Neither of these activities permitted the Fed to play favorites. But the programs that the GAO audited are fundamentally different. They allowed the Fed to choose winners and losers.

So what does all this mean? Here are some short observations:

(1) In the case of TARP, at least The People’s representatives got a vote. In the case of the Fed’s bailouts, which were roughly 20 times as substantial, there was never any vote. Unelected functionaries, with all sorts of ties to Wall Street, handed out trillions of dollars to Wall Street. That’s not how a democracy should function, or even can function.

(2) The notion that this was all without risk, just because the Fed can keep printing money, is both laughable and cryable (if that were a word). Leaving aside the example of Germany’s hyperinflation in 1923, we have the more recent examples of Iceland (75% of GNP gone when the central bank took over three failed banks) and Ireland (100% of GNP gone when the central bank tried to rescue property firms).

(3) In the same way that American troops cannot act as police officers for the world, our central bank cannot act as piggy bank for the world. If the European Central Bank wants to bail out UBS, fine. But there is no reason why our money should be involved in that.

(4) For the Fed to pick and choose among aid recipients, and then pick and choose who takes a “haircut” and who doesn’t, is both corporate welfare and socialism. The Fed is a central bank, not a barber shop.

(5) The main, if not the sole, qualification for getting help from the Fed was to have lost huge amounts of money. The Fed bailouts rewarded failure, and penalized success. (If you don’t believe me, ask Jamie Dimon at JP Morgan.) The Fed helped the losers to squander and destroy even more capital.

(6) During all the time that the Fed was stuffing money into the pockets of failed banks, many Americans couldn’t borrow a dime for a home, a car, or anything else. If the Fed had extended $26 trillion in credit to the American people instead of Wall Street, would there be 24 million Americans today who can’t find a full-time job?

[…] Breakdown of the $26 Trillion the Federal Reserve Handed Out to Save Incompetent, but Rich Investors (johnhively.wordpress.com) […]

LikeLike

[…] Breakdown of the $26 Trillion the Federal Reserve Handed Out to Save Incompetent, but Rich Investors (johnhively.wordpress.com) […]

LikeLike

[…] Alan Grayson and Congressman Bernie Sanders to audit the Federal Reserve, we now know that the Federal Reserve secretly lent out 26 trillion dollars’ worth of American money from 2007 t… Twenty. Six. TRILLION. Dollars. Here is a small part of the letter where Congressman Alan Grayson […]

LikeLike

[…] Alan Grayson and Congressman Bernie Sanders to audit the Federal Reserve, we now know that the Federal Reserve secretly lent out 26 trillion dollars’ worth of American money from 2007 t… Twenty. Six. TRILLION. Dollars. Here is a small part of the letter where Congressman Alan Grayson […]

LikeLike

These are not American money. These are Federal Reserve Notes, private money, and they could loan it to anyone they deem appropriate. I don’t see anything illegal here. They loan the money to America, why can’t the loan it to Italy, for example.

LikeLike

Because the more fiat currency created and put into circulation (even on the international market), the more the value of the dollar drops. Fake money is just that. It’s fake. They’re printing more and more at this time, just to keep the dollar from crashing, and the loss of the petro dollar. But, that’s inevitable. It will happen, we just don’t know when. The more they print, the sooner it will happen. And, they do things on THEIR time, not on ours. The Fed owns everything and controls everything, including Wall st and the international market.

LikeLike

It is hard to believe that this kind of evil exists. That our whole country will deteriorate if we do not have a miracle happen…..due to what has been allowed to happen with Congress consent. I hope and pray that all in government, along with the Federal Reserve that are responsible, along with their scum bag cronies,…. will be brought out in public and prosecuted, held accountable… No wonder all of our Judicial system stinks and president and his cabinet along with Congress will lie, cheat, steal, bribe and murder to be in Washington for the power and moneyTAKE! God help us!

LikeLike

great article!

LikeLike

[…] Alan Grayson and Congressman Bernie Sanders to audit the Federal Reserve, we now know that the Federal Reserve secretly lent out 26 trillion dollars’ worth of American money from 2007 t… Twenty. Six. TRILLION. Dollars. Here is a small part of the letter where Congressman Alan Grayson […]

LikeLike

[…] Alan Grayson and Congressman Bernie Sanders to audit the Federal Reserve, we now know that the Federal Reserve secretly lent out 26 trillion dollars’ worth of American money from 2007 t… Twenty. Six. TRILLION. Dollars. Here is a small part of the letter where Congressman Alan Grayson […]

LikeLike

[…] Alan Grayson and Congressman Bernie Sanders to audit the Federal Reserve, we now know that the Federal Reserve secretly lent out 26 trillion dollars’ worth of American money from 2007 t… Twenty. Six. TRILLION. Dollars. Here is a small part of the letter where Congressman Alan Grayson […]

LikeLike

[…] Alan Grayson and Congressman Bernie Sanders to audit the Federal Reserve, we now know that the Federal Reserve secretly lent out 26 trillion dollars’ worth of American money from 2007 t… Twenty. Six. TRILLION. Dollars. Here is a small part of the letter where Congressman Alan Grayson […]

LikeLike

[…] Alan Grayson and Congressman Bernie Sanders to audit the Federal Reserve, we now know that the Federal Reserve secretly lent out 26 trillion dollars’ worth of American money from 2007 t… Twenty. Six. TRILLION. Dollars. Here is a small part of the letter where Congressman Alan Grayson […]

LikeLike

[…] Breakdown of the $26 Trillion the Federal Reserve Handed Out to Save Incompetent, but Rich Investor… […]

LikeLike

Thanks for visiting my blog. If you don’t mind, I’ll post a link to your website.

John

LikeLike

Some truly great blog posts on this website , thanks for contribution.

LikeLike

[…] welche die Federal Reserve überprüften wissen wir jetzt, dass die Federal Reserve heimlich 26 Billionen Dollar amerikanischen Geldes von 2007 bis 2010 an überwiegend ausländische Banken ausliehen. Sechsundzwanzig-Billionen […]

LikeLike

These were not bailouts but buybacks. In order to keep the Wall Street crooks behind the mortgage-backed securities fraud, the biggest financial crime in history, from being sent to prison (like their Icelandic counterparts) , Ben Bernanke is just printing up trillions in new dollars to buy back all that bad paper. In the process, Bernanke is devaluing the money you already worked for and saved, robbing Peter to pay … Sven. In addition, this covert hyper0inflation in destroying trust in the dollar around the world leading to the ever expanding solar “exclusion” zone of nations no longer willing to trade in dollars, which in turn will eventually collapse the dollar itself.

LikeLike

P.S. This why the people who got the money never paid it back. From their point of view it is a refund, not a loan.

LikeLike

Howdy

Why is it that some people wake up to the banking scams but still push the false left vs right paradigm?

A-holes, it isn’t a right wing or left wing thing. It is a bankster thing. They own both parties. They own the news media. They own the government.

Crikey but some of you people are thick

LikeLike

The Federal Reserve Bank of NY is owned by the people who received most of the money. The Fed can’t be audited. They are private Banks. You can audit the Fed Board, USG.

Don’t audit the Fed, just take it over into the Treasury so the profits of monetizing debt is in the Treasury and no more debt.

All this other talk is swinging at fast pitches in the dirt. We love Ron Paul and he’s the only one out there worth anything, but sadly he doesn’t get it either.

LikeLike

Endless bailouts, yet another violation of our rights. The gov’t constantly violates our rights.

They violate the 1st Amendment by caging protesters and banning books like “America Deceived II”.

They violate the 4th and 5th Amendment by allowing TSA to grope you.

They violate the entire Constitution by starting undeclared wars.

Impeach Obama, support Ron Paul.

Last link of “America Deceived II” before it is completely banned:

LikeLike

[…] Breakdown of the $26 Trillion the Federal Reserve Handed Out to Save Incompetent, but Rich Investors […]

LikeLike

[…] Bernie Sanders to audit the Federal Reserve we now know that the Federal Reserve secretly lent out 26 trillion dollars‘ worth of American money from 2007 to 2010 — much of it to foreign […]

LikeLike

[…] Breakdown of the $26 Trillion the Federal Reserve Handed Out to Save Incompetent, but Rich Investors […]

LikeLike

Holy cow!!!

LikeLike

Nothing i’ve blogged about the topic is as scary as this blog (which is simultaneously brilliant). Thanks!

LikeLike

Everyone needs to read this!

LikeLike

Wow, I didn’t realize it was actually $26 trillion. Great post! This was a useful site that I found on the Fed and it’s corruption: http://www.corruptfederalreserve.com

LikeLike

[…] Alan Grayson and Congressman Bernie Sanders to audit the Federal Reserve, we now know that the Federal Reserve secretly lent out 26 trillion dollars’ worth of American money from 2007 t… Twenty. Six. TRILLION. Dollars. This is a very difficult number to comprehend — but we do […]

LikeLike

[…] Alan Grayson and Congressman Bernie Sanders to audit the Federal Reserve, we now know that the Federal Reserve secretly lent out 26 trillion dollars’ worth of American money from 2007 t… Twenty. Six. TRILLION. Dollars. This is a very difficult number to comprehend — but we do […]

LikeLike

Thanks for giving my blog a look over. I appreciate it. Also, thanks for giving me the heads up to the http://usdebt.kleptocracy.us/ website!

LikeLike

The Fed was paid off in full with toxic assets, which they still hold. I’m offering several million dollar bonds, but nobody seems to be interested in buying them. I have no idea why. They are guaranteed by my full faith and credit.

LikeLike

Everything published was actually very logical. However, what about this? suppose you added a little information? I mean, I don’t want to tell you how to run your blog, however suppose you added a post title that grabbed folk’s attention? I mean Breakdown of the $26 Trillion the Federal Reserve Handed Out to Save Incompetent, but Rich Investors John Hively's Blog is kinda boring. You could glance at Yahoo’s home page and note how they write post headlines to grab people to click. You might add a video or a picture or two to get people excited about what you’ve written. In my opinion, it would bring your blog a little livelier.

LikeLike

motorna olja

Hi, can I use your post on my website with a linkback?

LikeLike

You can post a link to your website with a linkback on anything I publish. You don’t ever need to ask again.

LikeLike

I usually do not drop a bunch of remarks, but i did some searching and wound up here Breakdown of the $26 Trillion the Federal Reserve Handed Out to Save Incompetent, but Rich Investors John Hively's Blog. And I actually do have 2 questions for you if it’s allright. Could it be just me or does it look like a few of these responses come across like left by brain dead individuals? 😛 And, if you are posting at other online sites, I’d like to keep up with anything fresh you have to post. Would you make a list of all of all your public pages like your twitter feed, Facebook page or linkedin profile?

LikeLike

I believe this website has got some really good info for everyone :D. “America is not merely a nation but a nation of nations.” by Lyndon B. Johnson.

LikeLike

Twenty. Six. TRILLION. Dollars. This is a very difficult number to comprehend — but we do […]

LikeLike

[…] sheets, to John Hively — “The World’s Most Accurate Economic Forecaster Since 1989”. https://johnhively.wordpress.com/2011/12/05/breakdown-of-the-26-trillion-the-federal-reserve-handed-o… CONGRESSMAN GRAYSON: I wouldn’t want anyone to think that I’m dramatizing or amplifying what […]

LikeLike

Reblogged this on All About 2012 and commented:

Astonishing!

LikeLike

Pink Floyd’s lyrics to the song PIGS, THREE DIFFERNT ONES. “BIG MAN, PIG MAN, HA-HA CHARDE YOU ARE! YOU WELL HEELED BIG WHEEL, HA HA CHARADE YOU ARE! YOU RADIATE COLD SHAFTS OF BROKEN GLASS! …etc. Well when I was in college, I was taught that the way free markets worked was any business could enter the market, but success was not guaranteed, you were free to be successful and make a profit over your operating expenses and if you were unable to make a profit then you were free to fail and leave the market place and allow the more efficient competitors to take over the market share of consumer demand dollars left behind by the insolvent producer. A business that becomes insolvent, whether a BANK or an insurance company is supposed to be taken over by the government receiver and the doors are closed by either the FDIC or the State Insurance department guarantee fund manager and the depositors money that is insured to the FDIC limits of liability is paid out and any outstanding insurance claims are also settled up to the limits of liability of the State guarantee funds. The bank is then either rehabilitated in bankruptcy court if there is a sufficient number of investors that have faith to pony up the cash to satisfy legal reserve requirements to make either the bank or insurance company financially solvent and viable again or else the books of customer accounts, either depositors or premiums from insurance policy holders are sold off to more financially solvent carriers that assume the insurance policy liability contracts and the old insurance company or bank is liquiated and exits the market permanently. Nowhere was it ever claimed that ANY BANK OR INSURANCE COMPANY WAS TOO BIG TO FAIL, because to do so would reward inefficiency and incompetence and provide NO INCENTIVE TO WORK TO PROVIDE CONSUMERS WITH HE HIGHEST LEVEL OF BENEFITS AT THE LOWEST COST OVER THE COMPETITION.

LikeLike

Phillip,

Nice reference to Pink Floyd. Unfortunately what you were taught in college was the methodology for the common man. What they didn’t teach you was the economic methodology for the rich. I do agree with you that no business is “to big to fail” but as you can see, this is how the game is played. Here’s anotther example of how what we are taught is not the case. Supply and demand. How it really works is that prices go up simplly from the fear of the loss of supply, not the actual supply, due to futures trading. This is why gas prices shoot up everytime someone mentions war with Iran, or every time a hurricane approaches the Texas coast. Little by little people are waking up to the fact that what we have been taught is not how financial reality really works. Its a shell game.

LikeLike

It’s not even a shell game. It’s pretty much a free pass for industries to leverage prices whenever they wish. The world population are still pretty much slaves to control of governments by wealthy industry. Greed rules while humanity wanes and the planet is raped. So much for human imortality.

LikeLike

Unfortunately, it’s the same as it ever was,

Same as it ever was. The rich get richer and the poor get poorer.

LikeLike

I agree totally with you. Industries do leverage prices whenever they wish, for the most part.

LikeLike

Well maybe you can tell me why we, the majority, are so stupid as to put up with such obvious abuse and slavery, or is the human psyche so corrupt and greedy that personal power demands we make slaves of others?

If humanity has evolved, why do we still deal in fantasy instead of dealing with reality and why do we not have world government? Why are we, the people, not cooperating in making the world and the universe more human friendly. Me thinks evolution still has a tad more cooking to do before we control our ferrel stupidity. Is there no way to speed up the process?

LikeLike

It’s all happenening because for some people, simply being a billionaire is not enough.

LikeLike

Money means nothing. It’s the power and control the push the greed. It’s time we the people took control of the power guiding our future and rein in the greed of the few.

LikeLike

Interesting

LikeLike

The reason why the fed is doing what it is doing is because it knows its time is limited based on a successful law suit filed and won all the way to the Supreme Court, and Congress and the Senate in which there has been a gag order on it for quite some time now. This law suit has challenged the illegal corporate so-called government and requires that the government be restored to the original founding forefathers Republic form of government. The transition process has been a difficult one at best, but I can assure you all this is 100% true. I personally investigated it in early to mid 90’s and had one of the few complete copies. So be of good cheer because it will not be much longer before you see a complete new way of living emerge on a global scale. Sir. david Allan Raimer

LikeLike

[…] Alan Grayson and Congressman Bernie Sanders to audit the Federal Reserve, we now know that the Federal Reserve secretly lent out 26 trillion dollars’ worth of American money from 2007 t… Twenty. Six. TRILLION. Dollars. This is a very difficult number to comprehend — but we do […]

LikeLike

Reblogged this on HISTÓRIA da POLÍTICA and commented:

Add your thoughts here… (optional)

LikeLike

You’re so awesome! I do not suppose I’ve read through a single thing

like this before. So good to discover another person with a

few genuine thoughts on this issue. Really.. thanks for starting this up.

This web site is something that is required on the

internet, someone with a bit of originality!

LikeLike

Very informative. I wonder why the

other experts of this sector do not notice this.

You should proceed your writing. I am confident, you’ve a huge readers’ base

already!

LikeLike

[…] Alan Grayson and Congressman Bernie Sanders to audit the Federal Reserve, we now know that the Federal Reserve secretly lent out 26 trillion dollars’ worth of American money from 2007 t… Twenty. Six. TRILLION. Dollars. This is a very difficult number to comprehend — but we do […]

LikeLike

[…] De 26 biljoen die de Fed even uitleende aan een aantal banken, en alles wat de Fed kan doet de ECB ongetwijfeld ook. […]

LikeLike

[…] Sanders Grayson […]

LikeLike

[…] how us taxpayers are paying up $26 TRILLION in banker bad-decision-bailouts? What? $26 Trillion? No, that’s not right, it was $16. I’m sorry you were listening to the news, but they […]

LikeLike

I’m only going by what the congressional audit mentioned. The Fed doesn’t have the authority to give out taxpayer bailouts either. The Fed simply created the cash and out it went to whoever, whether it was the $26 trillion the official congressional audit mentions, or some other figure that you mention.

LikeLike

[…] https://johnhively.wordpress.com/2011/12/05/breakdown-of-the-26-trillion-the-federal-reserve-handed-o… […]

LikeLike

[…] sheets, to John Hively — “The World’s Most Accurate Economic Forecaster Since 1989”. https://johnhively.wordpress.com/2011/12/05/breakdown-of-the-26-trillion-the-federal-reserve-handed-o… CONGRESSMAN GRAYSON: I wouldn’t want anyone to think that I’m dramatizing or amplifying what […]

LikeLike

[…] Breakdown of the $26 Trillion the Federal Reserve Handed Out to Save Incompetent, but Rich Inve… […]

LikeLike

[…] Alan Grayson and Congressman Bernie Sanders to audit the Federal Reserve, we now know that the Federal Reserve secretly lent out 26 trillion dollars' worth of American money from 2007 to … Twenty. Six. TRILLION. Dollars. This is a very difficult number to comprehend […]

LikeLike

[…] congresista Bernie Sanders para auditar la Reserva Federal, ahora sabemos que la Reserva Federal prestó en secreto 26 billones de dólares de dinero estadounidense de 2007 a 2010 — en gran parte a bancos […]

LikeLike

[…] welche die Federal Reserve überprüften wissen wir jetzt, dass die Federal Reserve heimlich 26 Billionen Dollar amerikanischen Geldes von 2007 bis 2010 an überwiegend ausländische Banken […]

LikeLike

[…] 26 TRILLION DOLLARS OF FRAUD Thanks to heroic efforts of Congressman Ron Paul, former Congressman Alan Grayson and Congressman Bernie Sanders to audit the Federal Reserve, we now know that the Federal Reserve secretly lent out 26 trillion dollars’ worth of American money from 2007 t… […]

LikeLike

[…] Alan Grayson and Congressman Bernie Sanders to audit the Federal Reserve, we now know that the Federal Reserve secretly lent out 26 trillion dollars' worth of American money from 2007 to … Twenty. Six. TRILLION. Dollars. This is a very difficult number to comprehend […]

LikeLike

[…] Alan Grayson and Congressman Bernie Sanders to audit the Federal Reserve, we now know that the Federal Reserve secretly lent out 26 trillion dollars’ worth of American money from 2007 to 20… Twenty. Six. TRILLION. Dollars. This is a very difficult number to comprehend — but we do now […]

LikeLike

[…] nor what to do. Americans watched in horror as their own incomes and wealth shrank while more than $150 billion was funneled into each of four financial organizations: AIG, Citigroup, Fannie Mae, and Freddie Mac. This was equivalent to the cost of all hospital care […]

LikeLike

Reblogged this on Armory of the Revolution.

LikeLike

Shoot a rich person

LikeLike